Subscribe to our newsletter

The precision of shipping cost estimation is the foundation of both customer satisfaction and corporate success. WooCommerce store owners face several challenges when attempting to navigate the complexity of shipping calculations. Errors in this domain may result in elevated rates of cart abandonment, complaints from customers, and immediate effects on the profit margin.

Let’s discuss typical issues with WooCommerce shipping cost calculations. Additionally, we will offer workable fixes to ensure your shipping procedures help your company’s profitability.

WooCommerce equips store owners with a powerful set of tools to calculate shipping costs. These tools utilize variables such as product weight, dimensions, and shipping destinations to determine the final charge to the customer. This flexibility, however, introduces complexity. To avoid calculation errors, store owners must thoroughly understand shipping settings, zones, and methods.

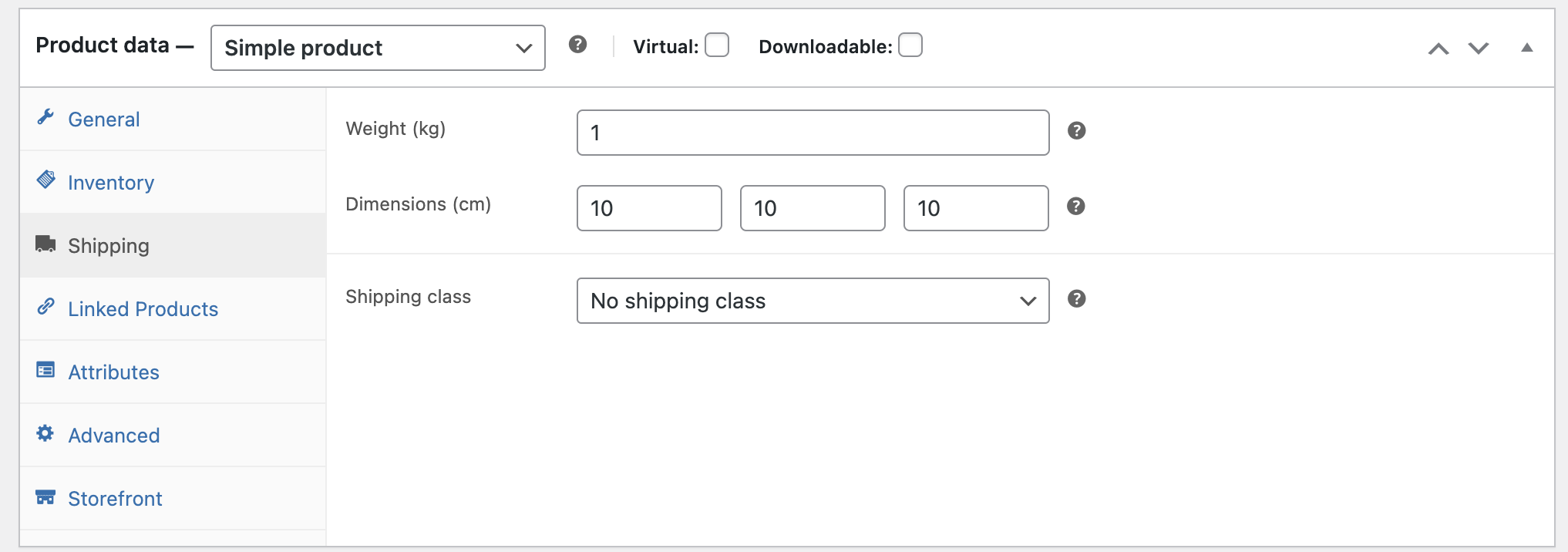

If your store bases its shipping charges on product data, keeping shipping prices current can be a task that increases with the size of your site and the number of items you sell. Inaccurate product data entry may result in erroneous shipping rate computations, leading to overcharging or shipping losses.

Product data that may affect the cost of shipping:

Solutions:

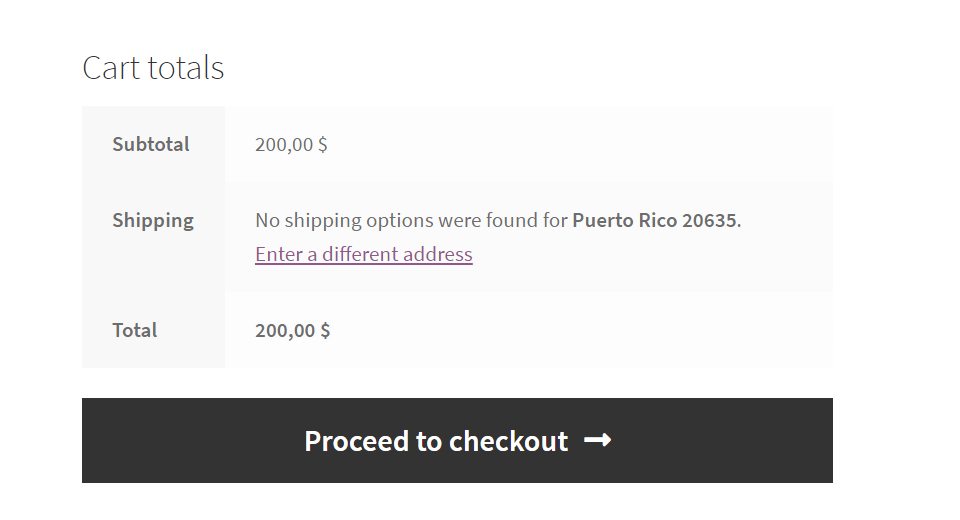

Customers may be discouraged from completing their orders if wrong shipping charges are applied at checkout due to improper setups in WooCommerce Shipping Zones. For example, consumers from certain places may be charged inaccurate shipping prices or may not be provided any delivery alternatives at all if a shipping zone is not properly specified to cover all relevant territories.

Shipping zones in WooCommerce are geographical areas where specific shipping methods apply. Understanding how to set up and manage these zones is crucial for ensuring that the correct shipping options are available to customers based on their location. Creating shipping zones involves identifying various geographic areas where you plan to deliver your products. This method allows for categorizing regions, ranging from entire continents and countries to more specific states, provinces, and even distinct ZIP or postal codes.

A key advantage of shipping zones is their ability to accommodate different shipping methods for each designated area. This feature ensures that customers only view and select shipping options applicable to their specific location, determined by the address information they provide or by geolocation technology. This tailored approach enhances the customer experience and streamlines the shipping process.

The shipping zone matching process in WooCommerce operates by analyzing the address inputted during the cart stage. It sequentially evaluates this address against the pre-established list of shipping zones, beginning from the top and moving downwards through the list.

In this system, if the shipping address matches with, for instance, the initial zone in the list, the subsequent zones are not considered. This ensures a streamlined matching process where the first relevant zone is immediately selected, enhancing efficiency in determining the appropriate shipping options.

Solutions:

Another WooCommerce Shipping Cost Calculation common mistake among WooCommerce store owners in the shipping cost calculation is not utilizing dynamic shipping rates, leading to inaccuracies in shipping charges. The absence of dynamic rates may lead to undercharging, reducing profit margins, or overcharging, which turns away customers and raises cart abandonment. Dynamic shipping rates are essential to ensure that consumers are charged fairly and adequately for shipping. They alter in real-time based on variables including destination, package weight, dimensions, and selected delivery type.

A store that does not offer dynamic shipping rates cannot provide customers with the most accurate and fair shipping costs. This lack of precision often results in flat rates or free shipping strategies that don’t consider the actual shipping costs involved. While these methods seem like an easy solution, they can inadvertently lead to a significant disparity between the charged and actual shipping costs.

Solutions:

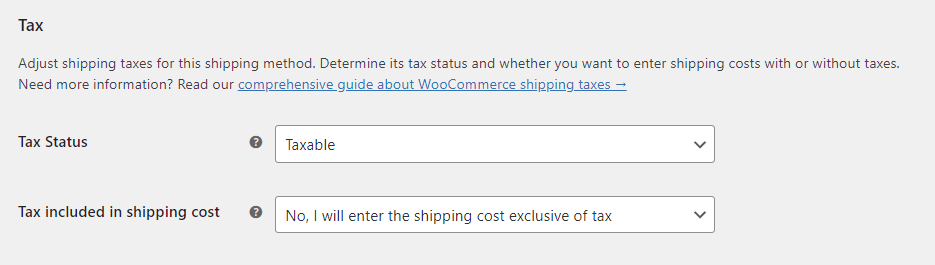

Taxes represent a significant challenge for many WooCommerce store owners. It can impact both regulatory compliance and customer satisfaction. The complexity of tax laws, which vary widely by region and country, adds layers of difficulty in accurately calculating taxes on shipping. These errors can arise from misconfigurations within WooCommerce settings, where shipping taxes are not properly aligned with the applicable tax rates for different jurisdictions. Such discrepancies can lead to either overcharging or undercharging customers for tax, affecting the store’s trustworthiness and potentially leading to legal complications.

Additionally, the configuration of tax costs in WooCommerce is a widespread problem, which also applies to determining shipping costs. You can enter prices in your store, including or exclusive of tax, then configure displaying them with or without tax. You can find a detailed breakdown of shipping tax settings in our guide.

Solutions:

The Flexible Shipping plugin is designed to streamline the tax configuration process for shipping. It allows direct specification of shipping costs inclusive of tax within the shipping method setup, bypassing complex calculations and potential errors.

The best Table Rate Shipping for WooCommerce. Period. Create shipping rules based on weight, order totals, or item count.

View Details or Add to cartThe whole thing occurs on the shipping method added with the Flexible Shipping plugin in your shipping zone. All you have to do is add the Flexible Shipping method, and you will find the tax settings. By default they look like this:

With these settings, the shipping method and its costs behave like a regular shipping method in WooCommerce. However, when you set the Tax included in shipping cost option as Yes, I will enter the shipping cost inclusive of tax, the shipping method will change a lot. With this setting, all shipping costs will include tax rates regardless of WooCommerce settings. This way, you can manage the shipping cost and WooCommerce tax rate much more quickly.

Let’s try to step into the shoes of your store’s customers and see what mistakes look like from their perspective. In WooCommerce, shipping cost calculation issues generally fall into two categories. The first involves shipping methods not appearing on the checkout page. It can become a source of frustration for both store owners and customers. The second is the miscalculation of shipping costs, leading to either lost sales or unanticipated expenses. We’ll dissect these issues, exploring their various causes and presenting effective remedies.

Imagine that situation – your customer wants to purchase in your store. He has chosen the products, is satisfied with the choice, and goes to payment. However, it turns out that instead of shipping costs, he gets this message:

What will he do? Just abandon the cart and purchase somewhere else. How to avoid this? The best solution is to debug the shipping in WooCommerce so all the shipping options will be available. Often, this is traced back to misconfigured shipping zones within WooCommerce.

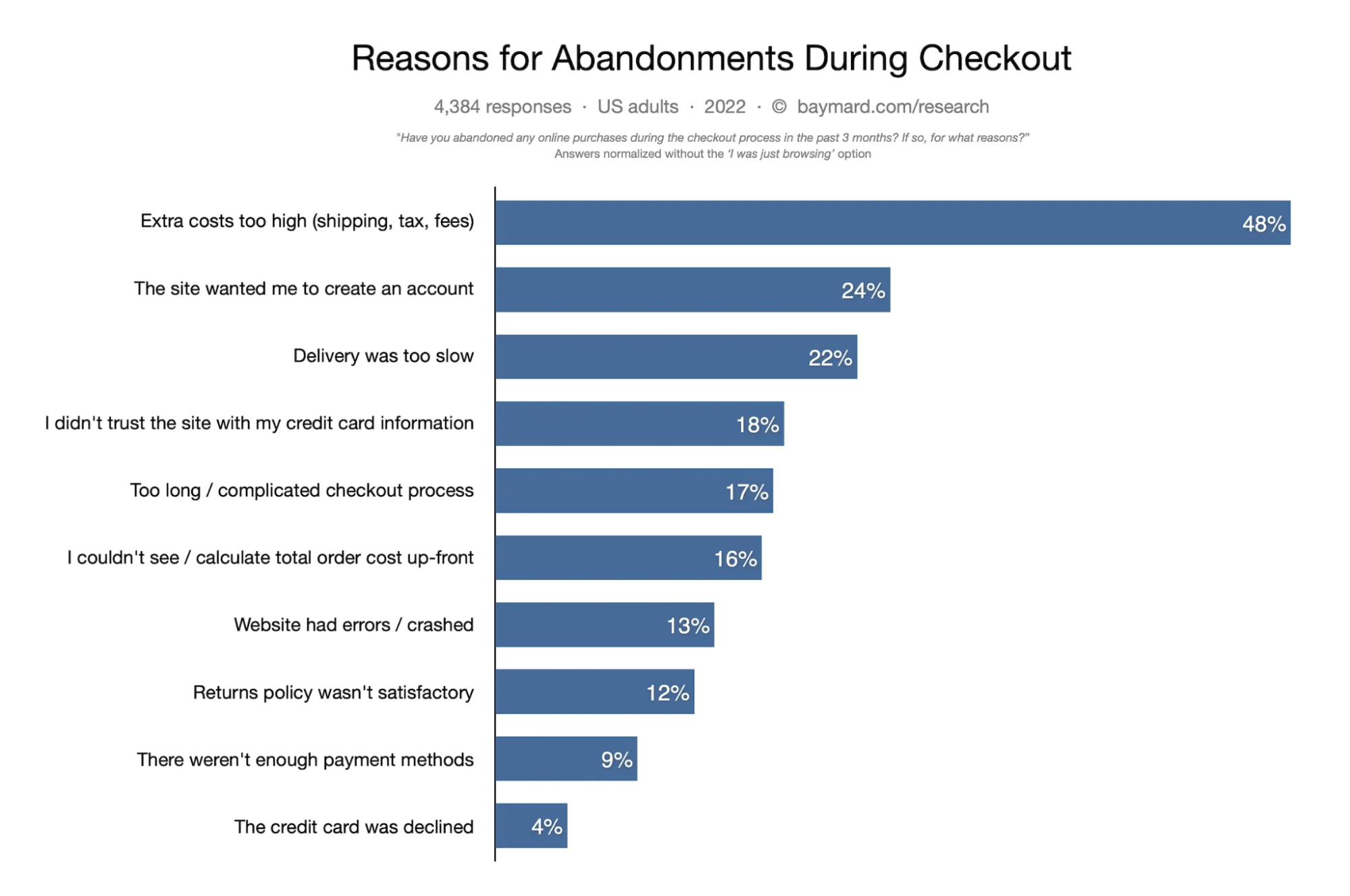

Inaccuracies in shipping costs can have significant repercussions. Overcharging leads to increased cart abandonment, while undercharging can erode profit margins. Without a doubt, it’s a crucial point of the purchase process. However, at this point, whether or not the sale will be closed depends on the quality of the experience you provide your customers. Let’s take a look at the reasons for abandonment during the checkout report from Baymard Institute.

Navigating the complexities of shipping cost calculations is pivotal for your customers’ satisfaction and your business’s success. This guide has delved into the common challenges you might face in ensuring accurate shipping charges, offering practical solutions to address these issues effectively. A deep understanding of shipping zones, methods, and precise product data is crucial. We’ve highlighted the importance of regular audits, leveraging dynamic shipping rates, and correctly configuring shipping zones and taxes to avoid common pitfalls.

The Neurodivergence Project uses the ocean and the natural world to empower neurodivergent people to build confidence, lasting friendships and help them achieve their goals.

Dominican Liturgical Center is based in Cracow and focused on promoting the learning of traditional music and singing. They also run a smaller publishing house and a webshop that is focused on selling mainly books and CDs.

Established in 2017. SGL is focused on selling gas bottles and non-gas products. Formerly, the company offered payment by card on delivery. For now, the SGL started online payments and they launched a webstore.